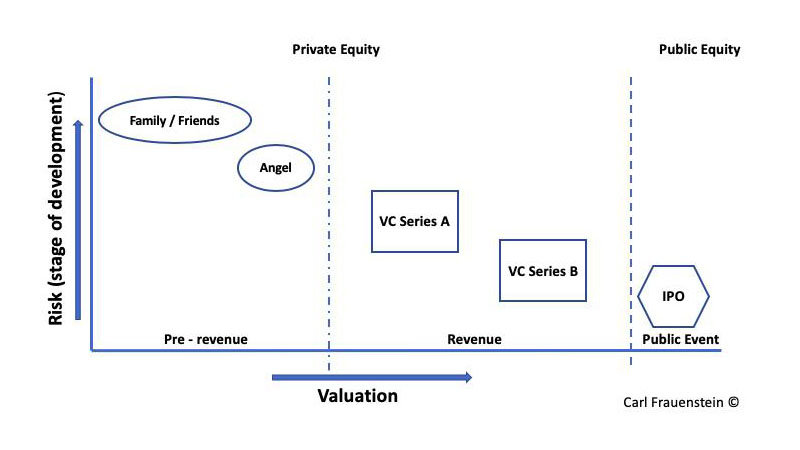

The principal challenge for Private Equity (PE) investors wanting to augment their portfolio with Innovation investments is to find the “golden nugget” early enough to enjoy a multiple return commensurate to risk. Traditionally, PE investors are categorized as “pre-revenue” and “post-revenue”; pre-revenue being family and friends for very early stage and angel investors following, and post revenue investors being Venture A and B funds. Within these, there exists a further delineation, however for purposes of this article, the above will suffice.

Essentially, this categorization describes the manner of investment, the process to investment and the desire and timing of exit. The challenge investors in both categories face is to determine the basis on which to invest and what valuation to agree on. The earlier the stage, the higher the risk and the more of a black art it is. The key is to keep the time and cost of decision-making (of which due diligence is a large part), as low as possible without missing potential pitfalls.

Various theories and models to guide investors in determining these 2 criteria (basis and valuation) of funding have been developed, tried and reworked in an attempt to improve results. It is clear that it is not an exact science.

MonacoTech, in striving to become a centre of excellence for innovation, is applying a specific development and growth program with the express goal of identifying potential very early, quantifying that potential and then nurturing and funding it accordingly. The key success factor is accepting that there are no short cuts. The program at MonacoTech is specifically focussed on ensuring the critical deliverables underpinning progress of an innovation idea through to viable commercialization within a sustainable company structure, are delivered with commensurate diligence and accuracy. It is these deliverables that have a significant, positive impact on the time-cost-quality of the investment decision. This is a key value proposition to all stakeholders engaging with MonacoTech.

Another factor influencing PE funding opportunities in innovation that is worth taking note of is the evolution of the driver of innovation over the past two decades. Historically, innovation was often driven by individuals with a quest. Due to the success of some of these, such as Apple, Google, Facebook and Skype, innovation became a mainstream activity for the hopeful, both on the side of the innovator as well as the side of the investor.

As innovation grew to become an industry, governments identified innovation as a means of stimulating the economy and catering for the ambitions and mindsets of the newer generations. In parallel, major players in the industry identified the benefits of becoming patrons of innovation and supporting innovators in their industry sector with the intent of providing mutually beneficial exits for successful projects.

These factors lead to various hybrid funding models catering to a combination of specific stakeholders in addition to the traditional funding vehicles: straight equity, convertible notes, collective fund investment (with individual investor decision) and managed funds to name a few.

MonacoTech, under the guidance of the Minister of Finance and in consultation with leading investor minds in Monaco, is currently developing a funding model to suit the needs of the Monaco innovation ecosystem. This funding model will be underpinned by the MonacoTech centre of excellence mission.