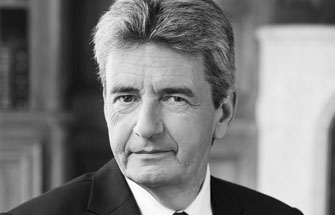

In December 2017, Société Générale de Banque au Liban bought out several KBL European Private Bankers subsidiaries. In July 2018, Banque Richelieu France (formerly BL Richelieu Private Bank), Banque Richelieu Monaco (formerly KBL Monaco Private Bankers) and Richelieu Gestion (formerly KBL Richelieu Gestion) formed a new group named La Compagnie Financière Richelieu. Philippe de Fontaine Vive, former Vice-President of the European Investment Bank, became its Managing Director. Meet him.

The Richelieu Group is very new. What is its goal?

To propose a new private banking offering in Europe, for Europeans and non- Europeans.

We want to create a brand with original genes and to develop it.

We are an agile bank, structured quite simply, with an entrepreneurial mindset.

Banque Richelieu France and Banque Richelieu Monaco are headed by a holding company, Compagnie Financière Richelieu, with Richelieu Gestion being the centre of expertise for asset management. The Group currently employs 160 people with euro 3 billion in managed assets, 2 billion of which in France and 1 billion in Monaco.

By creating a small European group with the management tasks (finance, audit and compliance) secured by the holding company, shared support functions and control functions ensured by the Compagnie Financière, our aim is to develop our own value. By 2021, we should be able to double our managed assets and to triple our lending business. We have sufficient capital to sustain organic development.

Is Monaco a target market for the Group?

The Monegasque customer base is at the heart of the Richelieu project.

Our target segment is company leaders, assets whose average personal amount exceeds one million euro. This type of customer can no longer benefit from customised services in the major banking industry. We wish to inform them and be vigilant for them, in an environment with numerous regulatory changes and significant risks. We offer to support their decisions through our advisors.

Wealth analysis is one of our strengths. We also have effective financial products in specific niche markets. But we can also refer our customers to solutions other than ours, when that is in their interest: everyone needs to focus on their own job in order to do it best.

Any other target countries?

European countries are our core target group.

Two other sectors interest us.

The Middle East: with Beirut, Abu Dhabi, Jordan and Cyprus.

Then Africa. In an environment with significant political risk, the banking ‘giants’ leave these countries. A small, agile bank can interest customers wanting to invest their assets in Europe. There is an offering opportunity for us.

What are your first impressions of Monaco?

By setting up in Monaco we become ambassadors for the positioning of the Principality. It is a safe country with strong digital security goals and a financial ecosystem in which all the financial professions are represented, as well as legal and tax ones.

We are convinced that all the European regulations are opportunities for customers. The data protection regime is unique in the world, for example. Every individual has control over their data, which they can access at any time. It is a way of ‘returning power to them’ on information relating to their history: medical records, levels of relations, consumption profiles etc. Monaco’s efforts on this matter are remarkable.